Best Place To Hold Crypto

To the million-dollar question….where is the best place to hold crypto?

There are nearly a dozen different kinds of ways to store your crypto.

The better question you should ask yourself: What is the best way and place, given my personal circumstances, FOR ME to store my cryptocurrency?

The answer: it depends.

There is no “one-size fits all” solution to location for storing crypto. However, there are more ideal solutions depending on your personal situation. The relevant factors that pertain to crypto storage are (but aren’t limited to):

- The amount of crypto you own (USD value)

- Your technical competency

- Your financial beneficiary inheritance needs

- Access to physical safes & security

- Single signature vs. multi-signature needs

For example, you don’t need to store your $20 bill inside a lockbox inside of a nationally sanctioned bank the same way you wouldn’t store $20 worth of BTC in a multi-signature hardware wallet custodial setup.

On the other end of the spectrum, if you’re a public figure, who is on record saying they own over 7-figures worth of crypto, a multi-signature custodial setup would be the best option for you.

Custom Cryptocurrency Storage Solutions

If you enter in your situational information I’ll respond (in no less than two days) with a custom suggestion for the best place to hold crypto.

Types of Crypto Storage

There are roughly three classifications you can categorize all types of crypto storage in. They are:

- Third-party custodianship

- Self-ownership

- Hybrid solutions.

Category #1 – Third-Party Crypto Storage

There are three most common third-party crypto storage options. Exchanges, Custodians, and Mobile Wallets. You will find the best place to hold crypto within one of these options.

Cryptocurrency Exchanges

There are two most common third-party crypto storage options. Exchanges and Custodians.

Exchanges are online platforms where you can buy, trade, and sell several types of cryptocurrencies like BTC, ETH, Solana, etc. When using exchanges it is important to understand that you don’t have access to your private keys. You have access to your account, and the exchange manages your keys for you. You can’t see the private keys, you can’t obtain them as an account user, but you can transfer your assets out of the exchange to a type of storage that allows personal private key ownership.

The primary benefit of using an exchange is the risk and responsibility of securing your private keys are owned by the company, and not you personally. So even if you get locked out of your account, as long as you can reverify your identity, you don’t lose your crypto assets. The major downside is that coins stored on these exchanges aren’t purely your coins they are “paper coins”, Bitcoin IOUs, or legal promises that you will always have access to them. If there is a “bank run” i.e. too many people all at once try to withdraw their crypto, there may not be enough liquidity and the exchange can declare bankruptcy and then your crypto is gone.

There are dozens if not hundreds of exchanges worldwide at this point. The most popular ones are Coinbase, Gemini, Binance, Crypto.com, and Kraken.

Cryptocurrency Custodians

A crypto custodian is an online platform (typically with desktop and mobile applications) that manages private key ownership for you. They are essentially crypto banks where you can store your crypto assets and protect them from theft. Typically, custodians don’t engage in fractional reserve crypto banking that could result in loss. They tend to hold directly all the crypto their client’s deposits with them purely for security and storage and charge a monthly fee for this service.

Crypto Custodial services can also store your bitcoin in cold storage, meaning that even if someone is able to access your account with username and email credentials, there are other checks and balances in place that can prevent theft.

Mobile Wallets

Mobile wallets are applications that live on your smartphones like iPhone or Android phone. Some mobile wallets directly store the bitcoin or crypto directly on the physical device, so if you lose your phone, you also lose your crypto. Other mobile wallets are stored in the cloud and can be backed up and accessed by seed recovery phrases (just like a hardware wallet).

Examples of mobile wallets are Muun wallet, Blue Wallet, MetaMask, and Coinbase Wallet.

Category #2 – Personal Crypto Storage

Personal crypto storage can be classified as you have 100% ownership and access to the private keys of the crypto wallet where your coins are held. With great power comes great responsibility. The benefit of this storage approach is that there is no third-party risk of losing your coins. The downside of this approach is that you are 100% responsible for not losing, and properly protecting your private keys.

If you lose your personal crypto storage devices such as a hardware wallet (and their recovery seed phrases) or a paper wallet, it’s gone for good.

Hardware Wallets

Hardware wallets are physical devices (about the size of a USB drive) that securely store your private keys to your crypto wallets. They allow for added checks and balances on accessing those private keys like pin passwords and recovery seed phrases.

However, the risk with hard wallets is that if someone physically steals your device and knows your pin code OR they have access to your seed recovery phrases they can steal all of your coins. This approach adds more personal responsibility into the user’s hands but de-risks the possibility of a third-party catorsphe like an exchange going into bankruptcy because their fractional reserves were too low. It allows comes with desktop applications and mobile applications so you can, in real-time, check the value of your holdings.

Paper Wallets

Crypto paper wallets and physical pieces of paper that list the public address of your wallet, the private keys in the form of all characters, and QR codes for both the address and private keys.

To be honest, I wouldn’t recommend using paper wallets for crypto storage. The user interaction with these devices is incredibly hard and risky if you don’t know what you’re doing. Sending and receiving assets to these paper wallets always require a third-party application – which can be easy to compromise. And they are fragile – they are just pieces of paper.

There are no brands that produce paper wallets, there are only applications and websites that facilitate the creation of them like 99Bitcoins or Gemini.

Custom Cryptocurrency Storage Solutions

If you enter your situational information I’ll respond (in no less than two days) with a custom suggestion for the best place to hold crypto

Category #3 – Hybrid Crypto Storage

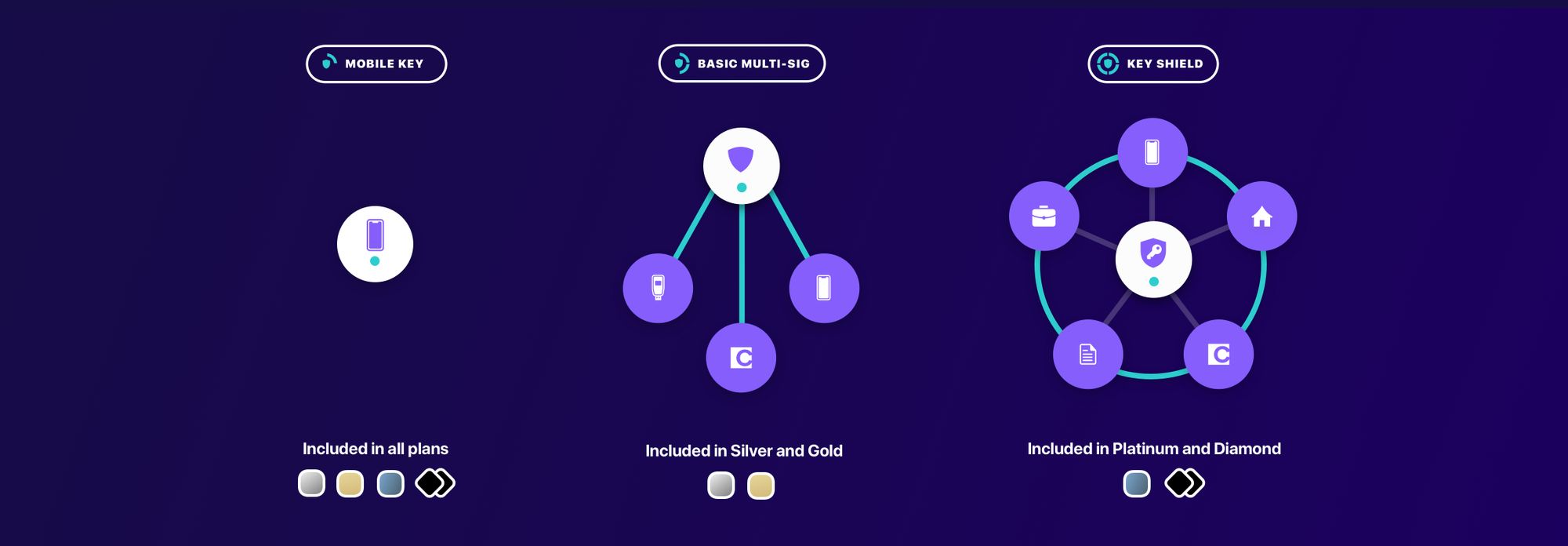

This category of “hybrid crypto storage” typically happens with multi-signature wallets. A multi-signature wallet is when you divide the private keys into at least 3 subkeys. In order to create a transaction, you need to use 2 out of the 3 keys to validate and sign the transaction. Or you can create even more signatures into the process like a 3-5 signature process or a 4-7 signature process.

Hybrid solutions usually consist of dividing the multiple signatures between hardware wallets, custodians, and mobile wallet applications. For example, when becoming a Casa customer, you can hold two of your keys on your own hardware wallets like a Ledger or Trezor and the third backup private key is on Casa’s platform accessible by their mobile application.

The image below can illustrate what that setup looks like.

This is by far the most complicated and cumbersome solution, but it is BY FAR the best if you’re trying to optimize for security in terms of the best place to hold crypto. With this type of crypto storage, If you have a hardware wallet stored physically at your house and some break-in and hold a gun to your head demanding you open the wallet and transfer the crypto to them, you can’t. You’d need to travel to the other physical location where the second key is held, or work with the custodian to gain access to their key (which has defense precautions built into it).

Crypto Cold Storage Consulting

Interested in cold storing your Bitcoin or crypto but too afraid to do it yourself? Visit my Crypto Cold Storage Consulting page for help. I consult with individuals on transferring their bitcoin from Coinbase to their Ledger wallet, or similar transactions.

Affiliate Link Disclosure

This post contains affiliate links. If you use these links to buy something we may earn a commission. Thanks.”