For context, I’m writing this post in February of 2022. It is my personal belief that Bitcoin is unstoppable at this point. I believe we are at the point of no return for this asset and ultimately the Bitcoin Standard. Below is my argument.

Setting The Stage

Things changed in March of 2020.

“No shit Sherlock” would be a proper response, but let me elaborate. I meant to say that things for Bitcoin changed in March of 2020, not just the world and its response from COVID-19.

Before unpacking that time period I want to set the following frame: the government’s response to the coronavirus was far more impactful than the virus itself.

Government Response to COVID-19

I want to highlight one word there, that word is the response.

Yes, obviously the virus exists, and has had a horrible impact on countless families that have lost loved ones, have had irreparable lung damage, and other impacts but I believe that the second and third-order consequences of the government’s responses and policies far outweigh the impact of the actual coronavirus.

The world of blockchain technology, more specifically Bitcoin will never be the same.

In order to understand Bitcoin’s relevance to that time period (March 2020), we need to zoom out a little bit of its past.

Bitcoin Major Hurdles

Bitcoin has defeated the majority of its enemies, in other words, jumped over the majority of the hurdles that should have stopped it up until that point. It is amazing that this decentralized asset, which is unseizable by governments, permissionless, and uncensorable made it this far.

Downright miraculous.

Just to mention a few hurdles (which I will unpack in more depth further in this post):

- Community debate/disagreements (internal civil war)

- Regulation

- Nation state attacks

- Competition (competing cryptocurrencies)

- Major exchange hacks (Mt. Gox, Bitfinex, etc.)

Those challenges didn’t kill it and every 10 minutes that the Bitcoin network flawlessly churns out another block the probability of its success increases.

Before the pandemic response, Bitcoin was beatable

I believe we are past the point of no return for Bitcoin. In this essay, I will lay out why I think we’ve crossed that chasm, and in the far future people will look back on March 2020 as the seminal moment Bitcoin became inevitable.

Before we can zoom into March 2020, let’s zoom out a bit. Let’s give some context and actual data to the growth of the Bitcoin network – seeing that it went from an asset worth literally nothing to a Market Cap of over one trillion dollars in just 12 years, something unprecedented in the history of our species.

Outline of Bitcoin’s Growth

Cryptocurrency Adoption Curve

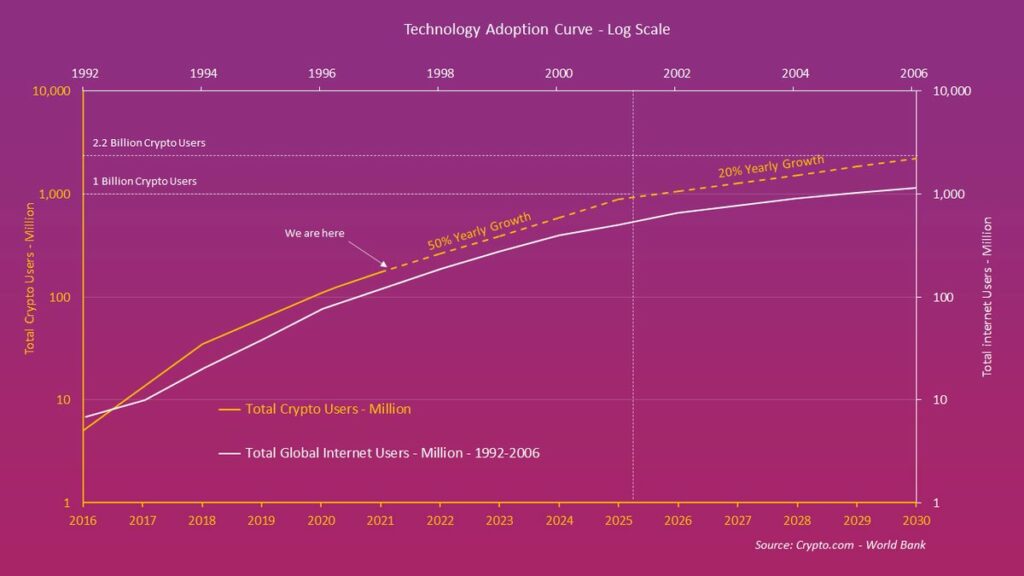

As I examined in my prior post about cryptocurrency adoption the industry is growing at a rate that parallels the internet.

As you can see below, the golden line in the graph is the number of users on the crypto networks (in a logarithmic scale) placed over the white line, which is the internet users, over a 14 year period. The internet user adoption curve is plotted along the timeline of 1992 to 2006 and the cryptocurrency adoption curve is plotted along the adoption timeline of 2016 projecting out to 2030.

The growth rates are virtually parallel. Given this trajectory we are on pace to have 2.2 Billion, that’s with a B, cryptocurrency users by the end of this decade.

Imagine the resulting infrastructure this will have. Imagine the price per bitcoin this will result in. Imagine the number of jobs this industry will give birth to – it could be on par with the internet itself.

“Bitcoin at $10,000 is an industry, bitcoin at $100,000 is a world power, and bitcoin at $1,000,000 is a global government.”

– Balaji Srinivasan

Active Wallet Address Metrics – GlassNode

Let’s dive a little deeper into the data. Glassnode is an amazing resource for examining metrics on the Bitcoin network. First, let’s examine the growth of active Bitcoin wallets.

Source: https://studio.glassnode.com/metrics?a=BTC&ema=7&m=addresses.ActiveCount&resolution=24h

According to this chart from studio.glassnode.com, there are around 1,000,000 daily active bitcoin wallet addresses on the network. You can see by the “up and to the right” trajectory it is following a path of growth.

Media Milestones

Another milestone? Media normalization. Bitcoin started being mentioned on major finance shows on major networks like MSNBC. Around 2017 it became a word the majority of Americans have at least heard of.

Then exposure went nuclear.

Tom Brady turned on his laser eyes on Twitter. Matt Damon and Lebron James both did crypto.com commercials (Lebron’s aired during the Superbowl). The major sports arena in Miami had its naming rights bought out by the FTX exchange. So did the Los Angeles Lakers stadium with their naming rights being bought out by crypto.com.

You can’t have a single week go by without analysts on the legacy media financial shows talking about its price per coin or market movements.

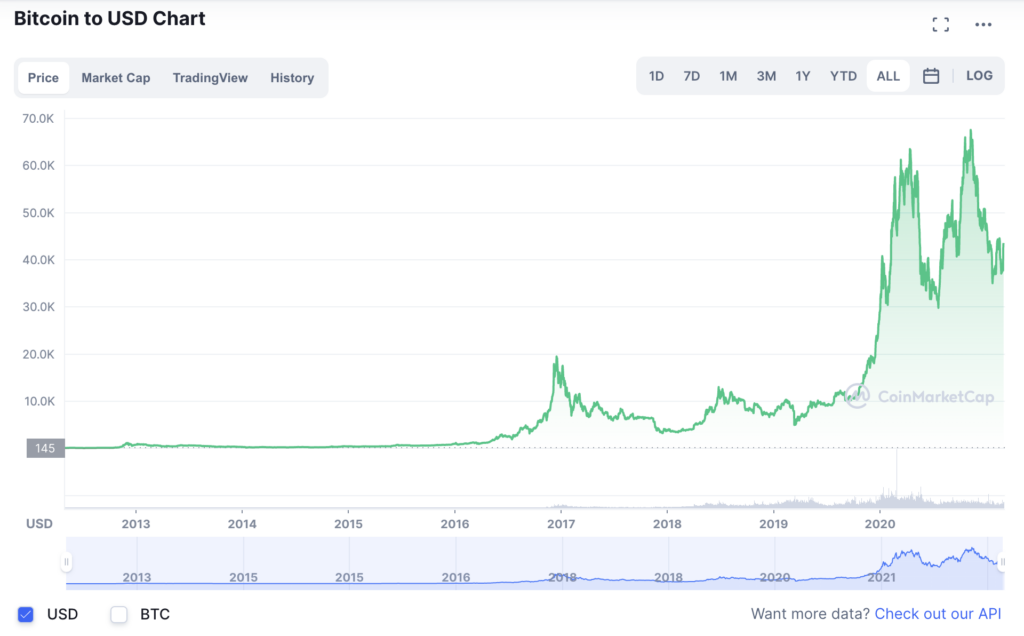

Pricing/Market Cap Milestones

Then there is the data point that matters the most: the market pricing. Below is a historic overview of the price of Bitcoin, from 2013 and onwards.

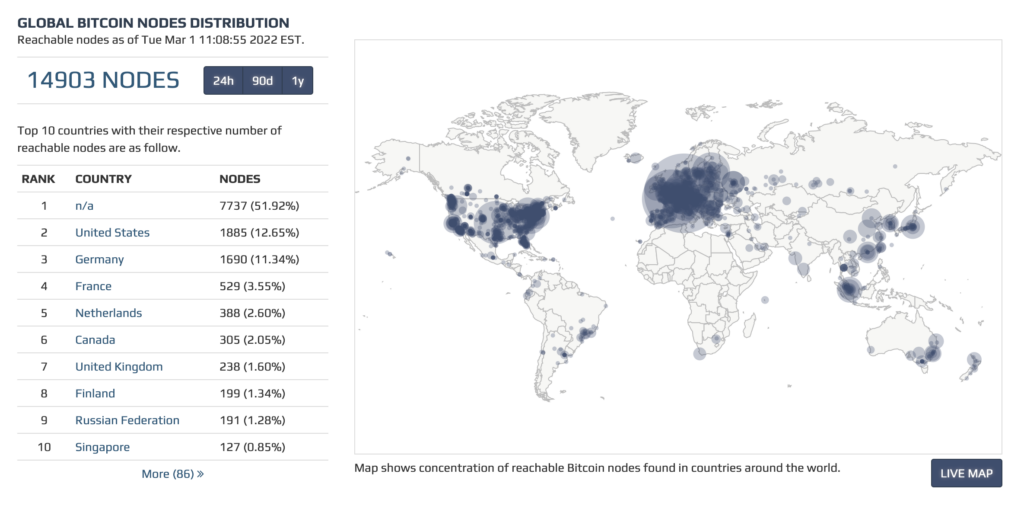

Number of Nodes

Source: https://bitnodes.io/

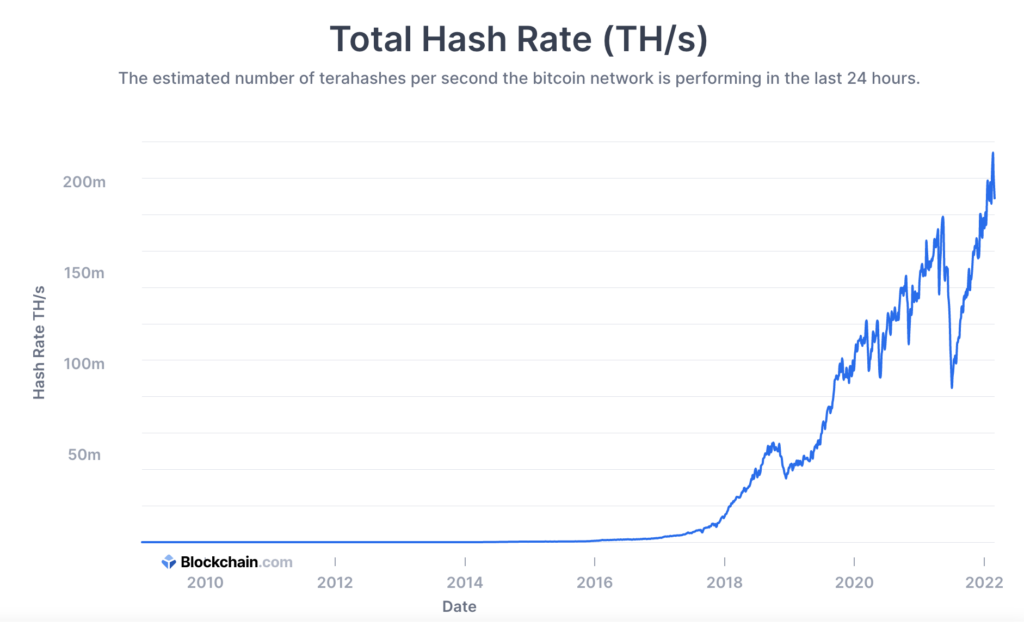

Mining Power (Hashrate)

Source: https://www.blockchain.com/charts/hash-rate

Corporate Milestones

In the financial markets, we had huge milestones in the past 12 months. The first major crypto company, Coinbase, went public in April 2021. This will not be the last. Other public companies in the space are but aren’t limited to, Bitfarms, Silvergate Capital, Proshares Bitcoin Strategy, and Signature Bank.

The Federal Government’s Response

Let’s return to the current moment that led us here, more specifically the United State’s Federal Government response to the coronavirus outbreak.

In response to the Coronavirus pandemic, the U.S. Federal Government printed over 18% of all dollars that have ever existed in hopes of igniting economic activity at the same time of locking down businesses, commerce, and travel.

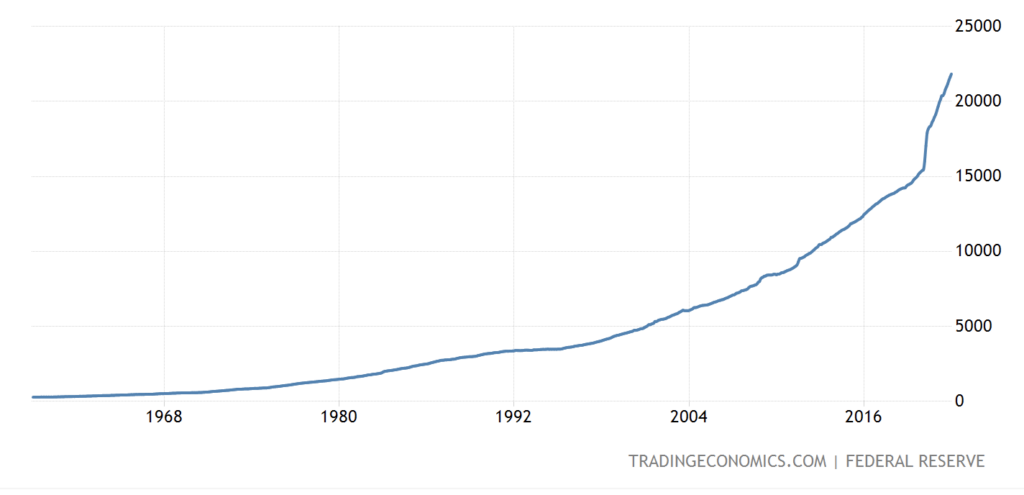

M2 Supply Expansion

The M2 money supply graph is a great visual representation:

Lockdowns (Restricting Commerce)

In addition to the expansion of the money supply, which robs the citizens of their current wealth, the government also mandated the restriction of certain economic activities. Concerts were canceled, conferences postponed or entirely abandoned, restaurants were forced to put a cap on in-person business. Here are

The economy and the free market aren’t just a switch you can turn on and off. Every major decision from a central planner has 2nd and 3rd order consequences, sometimes these consequences have an even greater impact than the original stimulus if left alone. Here are the industries that saw massive declines in revenue in the spring of 2020:

- Restaurants

- Airlines

- Gambling

- Tourism

- Hotels

- Movie Theatres

- Live Sports

- Live Music

- Conferences

- Cruises

- Film production

- Retail

- Theme Parks

- Gyms

- Transportation

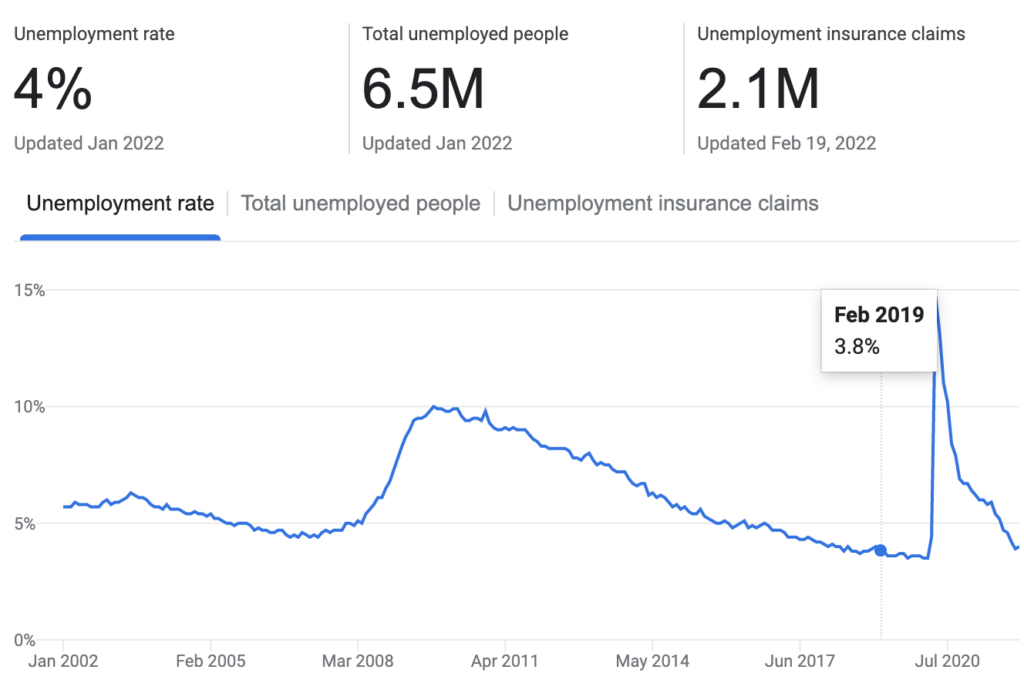

Unemployment Statistics

In February 2020 the national unemployment rate was at 3.5%. Then, just one month later it skyrocketed to 14.7% as a result of the shutdown.

Michael Saylor – The Canary in the Coal Mine

In comes Bitcoin as a solution. Look no further than the CEO of MicroStrategy, Michael Saylor’s rationale as to why Bitcoin was the number one safe haven in order to solve this problem.

Michael Saylor’s Background

Michael Saylor is the longest-tenured CEO of a public software company. The man has some street cred, to say the least. He has been known for spotting underpriced “digital assets” and making big bets on them. For example, in the early days of the internet, he started to buy and still holds to this day, many sought after and high-value domain names such as michael.com and hope.com.

He also was prescient with his ability to spot the trend of smartphones and how mobile technology would have such an outsized impact on our economy and lead to the explosion of the value of companies like Google, Facebook, and Amazon.

$500 Million Dollar Balance Sheet

In March of 2020, he had a problem, a MASSIVE problem. His company had over $500 million dollars of cash that were sitting on his balance sheet that was now losing an average value of purchasing power of 7% per year due to the monetary expansion just put in place. He thought he was being responsive and conservative by amassing this “war chest” but due to the impending devaluation of the dollar, it switched to an irresponsible action to hold onto that much cash at the current devaluation rate.

He deemed it the “melting ice cube” of the capital. What good is this block of capital (ice) if it’s melting away? What trade could he possibly make with this cash that would preserve the value of this war chest that he accumulated?

Searching for Solutions

At the end of March 2020, he began a full-fledged campaign to find a solution to this incoming problem.

He started working through the options. Commercial real estate? Nope, those markets were and still are in turmoil due to the “work from home” shift happening due to social distancing. Residential Real Estate was off the table as well.

Gold? Well not really, it’s returns historically weren’t outperforming the S&P 500.

The equities market? Could he really justify deploying $500 million dollars to his competitors to hold the value of the cash that his company accumulated? Slash that option off the list.

Last Stop: Bitcoin and “Crypto”

After going down the list there seemed to be really only one asset class left; Crypto. So he went down the crypto rabbit hole to solve his problem. He looked at the major ones on the list, Bitcoin, Ethereum, Cardano, and those at the top of the market cap list.

Doing The Research

But he had to take a second look at this asset he admittedly knew very little about. So in April of 2020 he went down the rabbit hole, and I mean deep down it. He consumed all the classic content. He listened to Robert Breedlove, he watched the famous Eric Vorhees vs. Peter Schiff debate, he read “The Bitcoin Standard” by Saifedean Ammous.

For months he unbiasedly started to take a closer look at a potential solution to his $500 million dollar problem.

Then ultimately came to the conclusion that Bitcoin was the solution and famously in August of 2020 made his first public purchase through MicroStrategy’s treasury of 21,454 Bitcoins for $250 million dollars.

History of MicroStrategy Bitcoin Purchases

MicroStrategy’s total holdings are 125,051 bitcoins as of January 31, 2022.

- 8/11/20 : 21,454 bitcoins purchased.

- 9/14/20: 16,796 bitcoins purchased.

- 12/4/20: 2,574 bitcoins purchased.

- 12/21/20: 29,646 bitcoins purchased.

- 1/22/21: 314 bitcoins purchased.

- 2/2/21: 295 bitcoins purchased.

- 2/24/21: 19,452 bitcoins purchased.

- 3/1/21: 328 bitcoins purchased.

- 3/5/21: 205 bitcoins purchased.

- 3/12/21: 262 bitcoins purchased.

- 4/5/21: 253 bitcoins purchased.

- 5/13/21: 271 bitcoins purchased.

- 5/18/21: 229 bitcoins purchased.

- 6/21/21: 13,005 bitcoins purchased.

- 9/13/21: 8,957 bitcoins purchased.

- 11/28/21: 7,002 bitcoins purchased.

- 12/8/2021: 1,434 bitcoins purchased.

- 12/30/2021: 1,914 bitcoins purchased.

- 1/1/2022: 660 bitcoins purchased.

Below is a snapshot of their purchase history.

Source: https://www.buybitcoinworldwide.com/microstrategy-statistics/

Hurdles Cleared

Bitcoin has ridden over many bumps in the road to get to its current destination, but it’s still here. There’s been threats from governments, internal civil war, major forks and divisions in the code base, regulatory issues, acceptability, propaganda, and major exchange hacks just to mention a few. Let’s go over a few of the major speed bumps it’s driven right over.

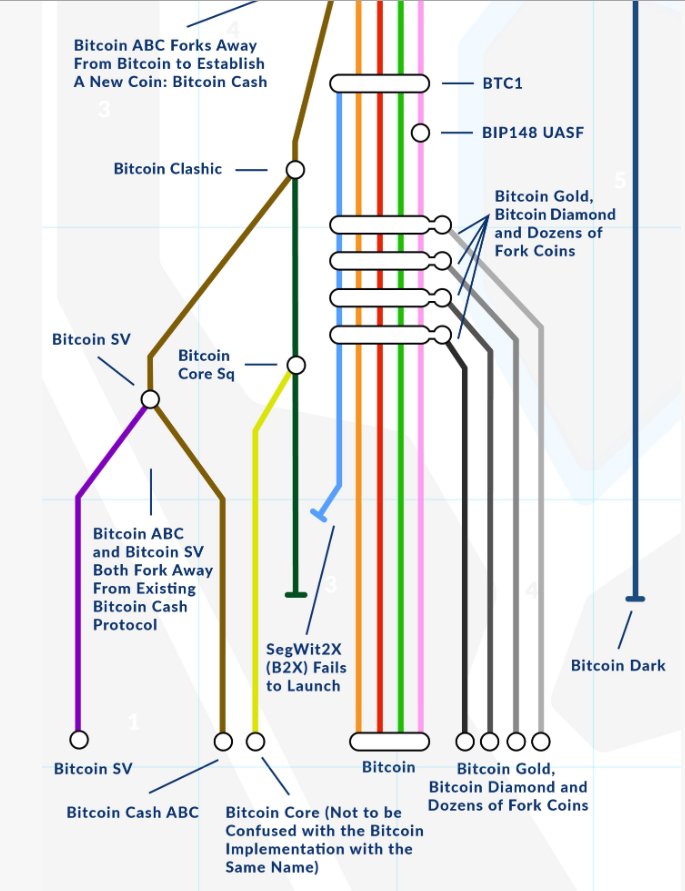

1 — The Block Size Debate/Bitcoin Cash Hard Fork

Back in 2017, there was a “civil war” of sorts within the community. There was a considerable debate between two sides; one side, which we will call Bitcoin OG (which stuck to the Bitcoin Core fork) wanted to keep the current size per block and not change so that time per block averaged around 10 minutes, and the other side, which we will call Bitcoin Cash, wanted to decrease the size per block in order to speed up transaction time in hopes of accelerating its adoption as a medium of exchange.

This debate nearly tore the community apart and could have potentially destroyed the entire project. The Bitcoin OG crowd eventually won out and the vast majority of the market cap continued to be poured into the original fork of Bitcoin Core and not Bitcoin Cash.

There have been countless in-fighting and forking over the years, but none have been so intense as this one. Just to get an idea of the forks and division the asset took look at this chart.

2 — Major Hacks

Does anyone remember the company by the name of Mount Gox? I wasn’t in the community at the time but I’m sure you’ve heard of it by now. On 24 February 2014, Mt. Gox suspended its entire business and its website went offline. A leaked internal crisis management document claimed that the company was dead, after having lost 744,408 bitcoins in a theft that went undetected for years. To put that into perspective the current market value of all those coins (writing this in February 2022) is estimated to be $28,151,277,336.

There have been many like this hack since it, like the Bitfinex hack of 2016. Even with all these road bumps the brand name and the Bitcoin Network itself have remained impenetrable. There has been no case of “hacking” the Bitcoin network itself, only exchanges and instances of social engineering people or institutions.

3 — Regulation

There have been many nation-state attacks on Bitcoin throughout the years like China recently outlawing all cryptocurrency mining in the summer of 2021, Algeria made the use of cryptocurrency illegal to buy, sell, use or hold after a 2018 law, Bolivia outright banning Bitcoin since 2014, and so on.

None of these regulations and bans have made any measurable dent in the network and its adoption (as noted by its market price growing an average of greater than 800% every year since its inception in 2009).

Source: https://i.redd.it/75x48tk0qu861.png

Regulation continues to add friction to the ownership process of Bitcoin and other cryptocurrencies like KYC policies, but that hasn’t stopped the price increases, user base increase, node proliferation, and mining industry from growing.

4 — Competition

Currently, on CoinMarketCap, there are 9363 listed coins in total. With the exception of Ethereum, none of these other projects are even at 10% of Bitcoin’s total market cap. Nor do any of them have the number of transactions, active wallets, or any other measurable metric comparable to the almighty Bitcoin.

There have been literally thousands of imitators and none of them have the track record, durability, recognizability, or decentralization characterizations of Bitcoin.

Let’s talk about decentralized “competition”.

To my knowledge the majority of the projects that are “competing” with Bitcoin, and I use that term very loosely, are actually decentralized like Bitcoin. The Ethereum team adjusts the total supply of ETH available at any moment’s notice, the developers at Solana are known and a “centralized” team. There has been no “admin” of the Bitcoin network since Satoshi vanished from the project in 2010.

There have only been users, no centralized controllers. The vast majority of these other projects and just attempts at getting rich by the founders.

Macro Forces Pushing Market Adoption

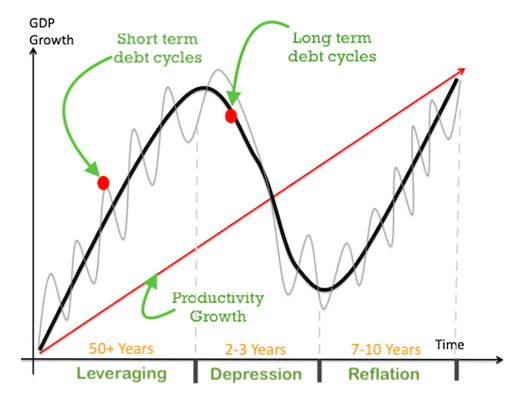

Long Term Debt Cycle

Ray Dalio is famous for explaining how our debt cycles occur in about 80 loops or cycles. Below is a graphic that depicts this process. The problem is that we are right at the crest before the massive fall. We are at the end of an 80-year process, which last time led to the Great Depression.

Adjusting Equities Yield with Inflation

I was under the assumption that the stock market and public companies were growing year over year at a rate of about 7% every year.

I was wrong. What was happening was the devaluation of the dollar, not the increased value of public markets.

I wrote about it in this blog post of mine to outline that the growth in the equities market is just an illusion. If you denominate the value of the stock in gold, there is barely any growth at all. What we’ve been seeing in the equities market since 2001 is the devaluation of the dollar and not the increase in the value of equities.

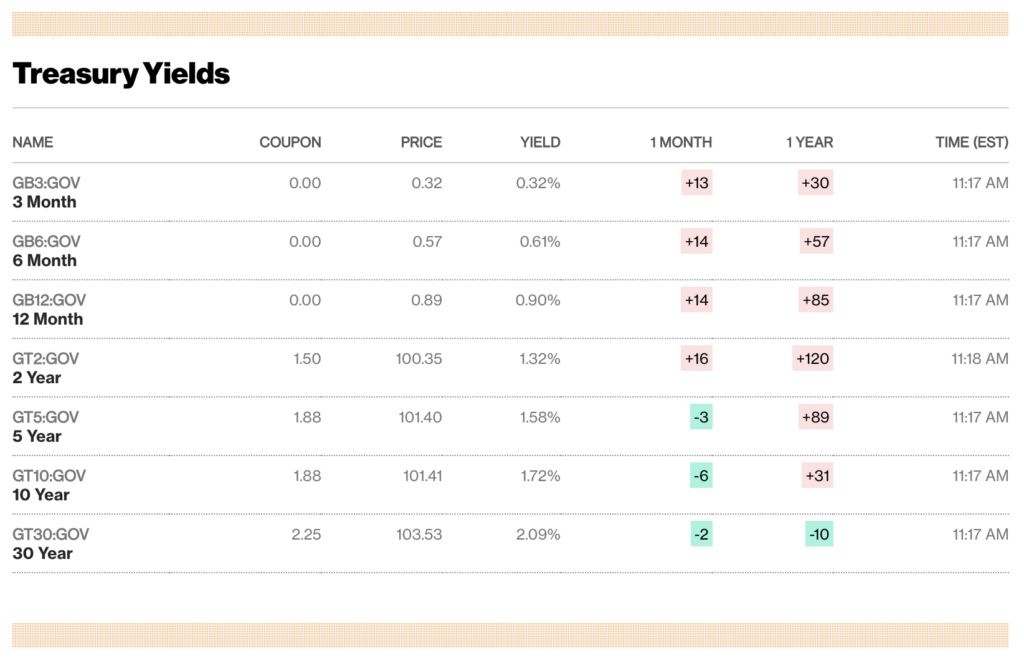

Negative Yield Bonds

Then you have the bond markets. For the first time in the history of recorded finance, we have negative yields becoming a norm. Why would you ever purchase such a product? Beyond that, if you look at government-backed treasuries, why on earth would you lock yourself into such low rates with the current expansion rate of the money supply? Does this seem like a good trade to you?

Source: https://www.bloomberg.com/markets/rates-bonds/government-bonds/us

Market Conclusion

Look around the markets. The bond markets, the equity markets, the commodity markets. Does anything seem priced right? Don’t things just seem like we’re in the upside-down world right now? The Price to Earnings ratio of the S&P 500 is at a historic high, or the first time in the history of recorded finance we’re seeing negative yields on bonds, the average housing price is up over 30% compared to the last fiscal year. We’re in looney tunes land. Nothing is making sense anymore.

Capital is fleeing the traditional markets to find any semblance of a safe store of value. The market is finally catching onto Bitcoin potentially being a sound place to park your money in comparison to the rest of the inflated assets available in the standard markets.

Building the Bitcoin Moat

We’ve reached a certain tipping point in 2020 in terms of Bitcoin being protected or building a “moat” around itself. One of the most seminal moments, from my humble point of view, was when MicroStrategy, in August 2020, headed by their CEO Michael Saylor, first purchased over 21,000 Bitcoins (at the price of around $11,000 per coin) to add to their public company balance sheet. Since this purchase, Michael Saylor and MicroStrategy have purchased over 120,000 Bitcoins, and I don’t see them stopping anytime soon

Public Company Holdings

The public company balance sheet doesn’t just stop with MicroStrategy. Here is a current list of public companies that hold Bitcoin on their balance sheets:

- Tesla

- Galaxy Digital Holdings

- Square

- Marathon Patent Group

- Hut 8 Mining Corp

- Coinbase

To name a few. There are nearly 30 public companies (that have publicly shared) their adoption of Bitcoin to their balance sheet.

Hedge Fund Allocation

On top of public companies adding hundreds of millions of dollars of this asset to their balance sheets we’ve had world-renowned asset managers like Paul Tudor Jones publicly announcing that he will be adding a percentage of Bitcoin to his portfolio holdings as well.

High Profile Investors

Not to mention other celebrity investors jumping on board. Kevin O’Leary aka “Mr. Wonderful” of Shark Tank fame is on record with putting over 10% of his entire portfolio in crypto. He says he may even push that number up to 20% of his overall holdings.

There is no shortage of high-profile entrepreneurs or famous investors (with the exception of the dinosaurs Buffett and Munger) that have publicly admitted to their possession and advocacy of Bitcoin and other cryptocurrencies.

International Government Adoption

History was made when the country El Salvador, was the first country to make Bitcoin legal tender on top of purchasing hundreds of Bitcoins for their countries reserves in the summer of 2021.

Since their initial purchase, they have continued to amass hundreds of additional Bitcoin to their treasury and it doesn’t look like they are going to stop anytime soon. They also have unveiled plans to build Bitcoin mining infrastructure by harnessing the thermal energy from their nation’s volcanoes.

El Salvador has also created the ‘Bitcoin Beach”, an area of their country where the local economic infrastructure is being entirely built on top of the Bitcoin network so all commerce can be conducted with the use of satoshis or bitcoins.

In addition to all the progress happening in Central America, you can look further down south to see that Rio De Janeiro has committed to putting 1% of its city’s financial reserves into crypto.

Domestic Government Adoption

Then there has been municipal and state action happening domestically. We have city mayors like Mayor Francis Suarez leading the charge with pro-Bitcoin policies from Miami. New York City’s Mayor Eric Adams agreed to have a portion of his salary paid in Bitcoin and Ethereum.

As of writing this there are now at least 5 sitting members of the Senate who are publicly pro-Bitcoin including Senators like Cynthia Lummis of Wyoming and Senator Ted Cruz of Texas.

There are cities and states openly competing for the Bitcoin mining industry and talent that’s grown from this space. Texas is welcoming with open arms the Bitcoin mining industry.

Political candidates like Josh Mandel are openly running on a pro-Bitcoin platform hoping that this will resonate with their potential constituents and will be enough to get them into the office of the senate.

Advancing Crypto Infrastructure

Back in 2012, the ability to participate in this industry was incredibly limited. To my knowledge there were only two main exchanges at the time; Coinbase and Kraken. Hardware wallets didn’t really exist, and you had to still be pretty technical to store and transfer Bitcoin.

Number of Exchanges

Oh, how the times have changed. Currently, there are 313 exchanges listed on CoinMarket Cap.com. There are at least 100 companies that offer institutional custodianship of numerous cryptocurrencies. Those are companies like Nydig, Gemini, and Anchorage. So if you’re a public company, private company, nonprofit, College, or even Nation-State, you have a company that will handle the storage and security of your Bitcoin for you. If you’re an individual looking to secure your bitcoin off an exchange, hardware wallets like Cold Card, Trezor, and Ledger are great solutions.

Mining Industry Expansion

There are even Bitcoin mining pools that allow you to invest in Bitcoin mining without having to set up the physical hardware yourself, all you have to provide is the capital. A great example is Compass Mining.

In addition to the Bitcoin asset itself, the 21 million scarce units of the hardest money ever created in human history, there is the Bitcoin computer network. Which is a web of tens of thousands if not hundreds of thousands of individual nodes that are decentralized and censorship-resistant. Beyond using Bitcoin as a form of money you can leverage this network to build all kinds of applications on top of it, which many people have started to do.

Bitcoin Applications

In comes the company Strike. Strike allows for cross-border payments on the Bitcoin lightning network, for free. It is also a payment network that allows buyers and sellers to exchange goods and services in real-time just like Square. The crazy part about Strike is that you can even send digital dollars or any other fiat-based currency on this network without fees. Say Goodbye to Western Union, they’re already dead and they don’t even know it.

Beyond payments, we even have social networks being built upon the Bitcoin network. Worried about upcoming censorship from the CCP, Canada, or even the US Government? We have a solution for you and it’s called Zion.

Zion is a decentralized social network built on Bitcoin, it is designed to facilitate the free and open flow of content and payments between creators and their audiences.

Wealth of HODL’ers

Do you know which group is the fastest wealth accumulator in the world? Bitcoiners. Just by examining the bitcoin wallets with the largest balances, we can see that there are at least 13,000 individual wallets that hold at least $5 million dollars of bitcoin. There are at least 84 wallets that have over a billion dollars of bitcoin in their wallets as well. This influence can’t be understated. It’s not just Bezos, Gates, and Zuckerbergs of the world that will have disproportionate influence over our economy and ultimately our future, it will be bitcoiners as well. Eventually, it will be less likely to own one Bitcoin than to be a millionaire. Think about it, there are estimated to be about 40ish millionaires on this planet today and there will only ever be 21 million bitcoins.